How to Improve Cash Flow with Factoring

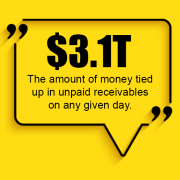

Despite its long history, invoice factoring remains a lesser-known financing option among many small business owners in the U.S., especially those in the B2B sector. This age-old method, also known as invoice discounting or receivables financing, offers a practical solution for managing cash flow and fostering growth.

What Is Invoice Factoring?

At its core, invoice factoring is straightforward: businesses sell their accounts receivable (i.e., outstanding invoices) to a third party, the Factor, at a discounted rate. This transaction not only simplifies financial management but also turns pending payments into immediate working capital.

Why Consider Invoice Factoring with Corsa Finance?

- Immediate Access to Working Capital: Factoring your invoices means unlocking up to 95% of the funds tied in accounts receivable, often within the same or the next business day. This swift access to cash supports essential operations, from payroll to new orders, without the wait.

- No Hidden Fees, Flexible Options: Transparent pricing at competitive rates makes factoring attractive to many businesses. The transaction is easy to understand and process.

- Expertise Across Industries: With decades of experience, our partners supports a diverse range of sectors, including temporary staffing, supply chain management, trucking, commercial cleaning, manufacturing, and more. Invoice factoring works successfully for businesses of all sizes and types, ensuring your specific needs are met.

- Personalized, Customer-Centric Service: Our partners offer fast approvals and funding without long-term contracts or minimums. Our dedication to personal service ensures you receive the support and guidance needed to navigate your financing options effectively.

How Does Factoring Benefit Your Business?

By choosing to factor invoices, you not only expedite your cash flow but also open doors to new opportunities. This financial strategy allows you to:

- Immediately reinvest in your business, stimulating growth and expansion.

- Manage payments and operational expenses more effectively, ensuring stability.

- Embrace larger projects and orders with confidence, knowing your financial base is solid.

- Reduce accounts receivable collection activities so you can focus on growing your business.

- Take advantage of early-pay price discounts.

- Access working capital without putting more debt on your balance sheet, keeping your bank covenants intact.

- Keep your vendors, contractors, and creditors happy with on-time payments.

Get Started Today

Ready to explore how invoice factoring can transform your business finances? Contact Corsa Finance for a no-cost, no-obligation quote. Discover the amount of working capital you can unlock by leveraging your accounts receivable. Whether you’re seeking to understand more about our services or ready to apply, we want to be a financial resource for you.

Empower your business with invoice factoring and turn your accounts receivable into a strategic asset that is working for you today. Contact us today to learn more or to start the application process.