High Credit Card Processing Fees and Their Impact on Business Profit Margins

Accepting electronic card payments is not just a convenience but a necessity for businesses aiming to meet customer expectations and increase sales. However, the convenience of card payments comes with its own set of challenges, notably the high costs associated with credit card processing fees. We recognize the crucial balance businesses need to maintain between offering electronic payment options and managing their profit margins.

Why Are Credit Card Processing Fees High?

Credit card processing fees are payments made by businesses to credit card processors as part of every transaction involving a credit card. These fees can vary significantly, typically ranging from 1.5% to 3.5% of each transaction. The fees are high due to several factors:

- Interchange Fees: Most of the cost comes from interchange fees, which are paid to the card-issuing banks. These fees cover handling costs, fraud, and bad debt costs, and the risk involved in approving the payment.

- Assessment Fees: Credit card networks (such as Visa, MasterCard, and American Express) charge these fees for using their payment networks.

- Payment Processor Fees: These are fees charged by the payment processors themselves for their services, which include transaction processing, authorization, settlement, and support.

Impact on Business Profit Margins

High processing fees can significantly eat into the profit margins of businesses, especially those with low-margin products or services. For small and medium-sized enterprises, these fees can be particularly burdensome, impacting their overall profitability and operational costs.

The Importance of Offering Electronic Card Payments

Despite the costs, according to the Forbes Business Council, accepting electronic payments offers numerous benefits that outweigh the profit-shaving disadvantages:

- Increased Sales: Consumers often prefer the convenience of card payments, leading to increased sales volumes and higher average ticket sizes.

- Faster transaction speeds: Rather than waiting for the proverbial “check in the mail,” get paid right away.

- Real-time Cash Flow Visibility: Your bank balance can update immediately and you can begin filling the client’s order knowing payment has been made.

- Increase accuracy: Companies can spend 6-10 labor hours per week processing and reconciling payments. Spend those hours on driving business instead of accounting for payments.

- Customer Satisfaction: Offering a preferred payment method enhances customer experience and can help build long-term loyalty.

- Competitive Edge: In an increasingly cashless world, businesses that do not accept electronic payments may lose out to competitors who do.

How Corsa Finance Can Help

We understand the dilemma businesses face regarding credit card processing fees. That’s why we offer solutions that help businesses find the most cost-effective and efficient processing options through our partners. We aim to minimize the impact on your profit margins while maintaining the convenience and security of electronic payments.

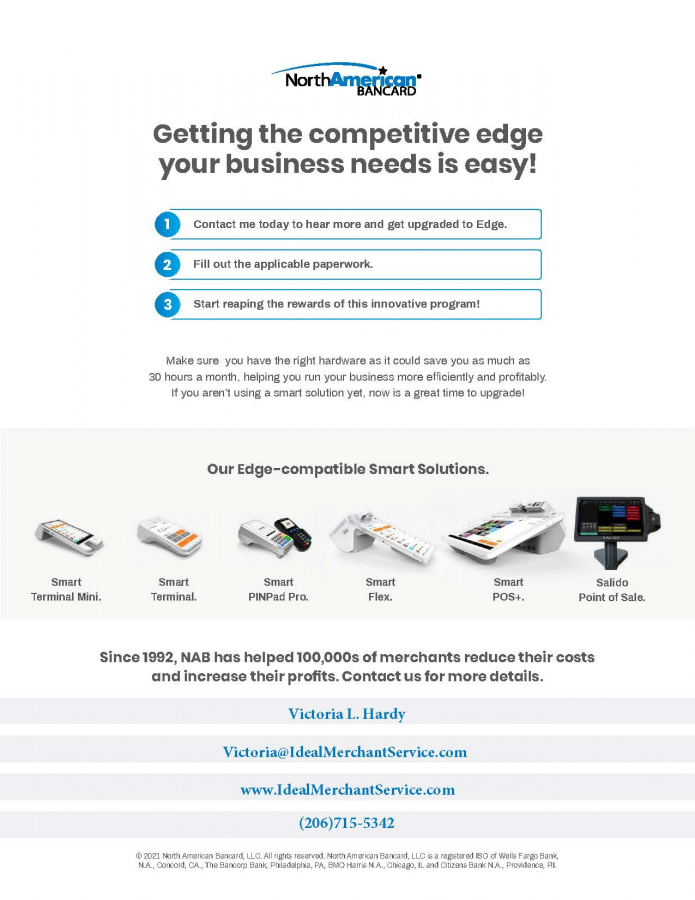

Let us help you navigate the complexities of credit card processing fees to enhance your profitability and customer satisfaction. Submit an inquiry, and our preferred business partner, Ideal Merchant Solutions, can help you determine whether Edge processing can help our business maintain its profit margins.

Submit an inquiry, and Victoria Hardy from Ideal Merchant Services will contact you!

Send us your contact information and we’ll contact you with more information about credit card processing