Solving the High Sales – Low Cash Flow Dilemma

For entrepreneurs, startups and small business, simply generating more sales might not be the answer. Successful businesses can still fail! Find out how to improve low cash flow to make your organization more sustainable.

Why low cash flow – not low sales – is the common lament of entrepreneurs

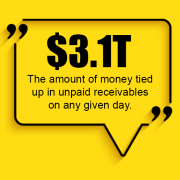

An article titled The Irony of Successful Sales Growth describes one of the challenges faced most often by small business owners and entrepreneurs as low cash flow. When an organization experiences low cash flow along with limited reserves and lack of resources (such as lack of investors or inability to obtain a bank loan), the seriousness of the situation can quickly become acute.

Many businesses that are successful – in that they are growing and increasing sales – can even create their own unique recipe for low cash flow when the need to purchase additional inventory, hire staff, or increasing operating expenses outpace incoming cash flow. This can be especially difficult for B2B sellers who often extend especially favorable terms to customers as a competitive advantage.

“The entrepreneur’s lament is one of the great ironies of the marketplace;

a small business in danger of failure as a result of extreme success.”

(Jim Blasingame, The Irony of Successful Sales Growth)

But the challenges presented by low cash flow are not only limited to organizations like (B2B) business-to-business companies that sell to customers on terms. Retailers and service organizations also face the challenge of making hefty investments in inventories before offsetting sales occur. If a retail organization’s projections about consumer demand do not match up with actual sales, they too may find themselves in a cash crunch.

Perhaps the best news for business owners trying to solve the challenge of low cash flow is that it is a common challenge, and there are many ways for a business to improve its cash flow. We previously shared an article with ten ways to maximize business cash flow that might also interest you further.

Here are some of the solutions for managing the challenge of low cash (or slow cash flow):

1. Plan for growth so that you know where the money and resources needed for fast reinvestment will come from.

2. Avoid use of operating cash for non-operating expenses (such as purchasing capital equipment).

3. Closely monitor accounts payable and accounts receivable

4. Understand the relationship between Accounts Receivable Days (how many days it takes customers to pay) and Accounts Payable Days (how long you have to pay vendors).

Ideally, you will have the option to work with vendors who will extend terms that make it possible for customer payments to come in before supplier invoices become due; however, that is not always going to be the case.

You may be able to speed up customer payments by offering discounts to customers who pay on delivery or who pay very quickly, requiring customers to make partial payments or deposits upfront, and conducting more thorough due diligence checks before extending customer credit. Plus, you can spend more time and money on collections efforts rather than taking a more passive approach to unpaid invoices.

Stop chasing customer payments – factor receivables for fast access to working capital

B2B organizations that invoice customers upon delivery of goods or completion of services may be able to immediately improve cash flow and better manage receivables by factoring – or selling – customer invoices to a factoring company.

When a client factors (or sells) an accounts receivable invoice to us, they receive funding for up to 95 percent of the face amount of the invoice for a small fee, called a factoring fee, within 1-2 business days. In this way, they can get access to the working capital they need to run and grow their operations long before their customer is required to pay.

Since factoring clients do not have to wait for customers to pay, they can reinvest in growing their business more quickly. They can also extend generous payment terms to their customers, which could create a competitive advantage.

Get a free, no-obligation quote for invoice factoring or request more information about the invoice factoring process.