Waiting on customer payments? Leverage these ideas to speed up business cash flow so you can focus on growing your business.

STUDY – 3 Out of 10 US Businesses Not Paid On Time

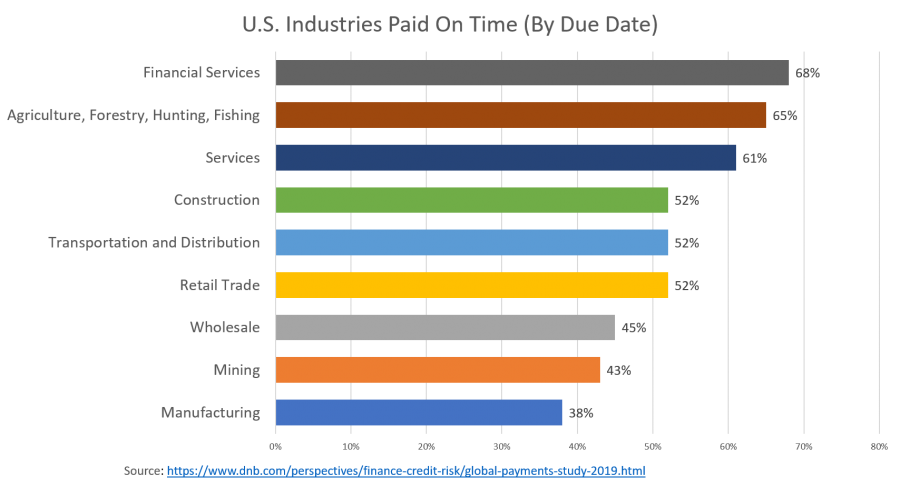

According to the 2018 Global Trade Credit Payments Study by Dun & Bradstreet, U.S. companies in many industries are not being paid on time. While nearly 7 in ten financial services invoices are paid by the due date, as few as 38 percent of manufacturing invoices are paid on time.

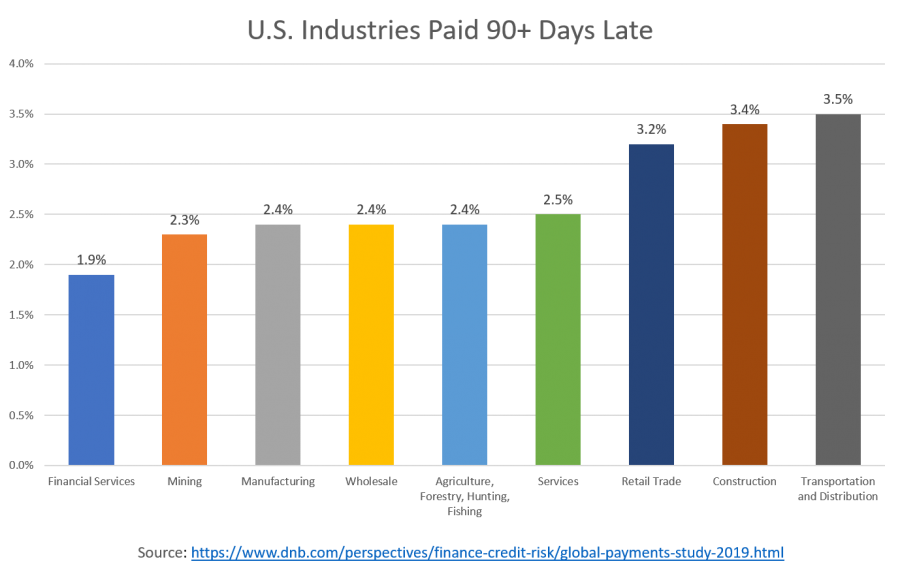

The Financial Services industry wins again when it comes to the fewest number of invoices that go beyond 90 plus days late before getting paid. Retail Trade, Construction and Transportation and Distribution industries have the most invoices that remain unpaid three months past their due date.

Whether your business falls into one of these categories or a different one, every business that invoices and waits on customer payments experiences some kind of opportunity cost while waiting to see these on-the-books receivables turn into working capital.

The Opportunity Cost of Slow Business Cash Flow

Yes, sitting around waiting on customers to pay accounts receivable invoices or for third parties to pay out your commissions and sales revenues does have a name: Opportunity cost. It’s the sum total of anything you couldn’t do because you had working capital owing on the books instead of in hand; such as:

- Waiting to replenish inventories or supplies

- Limiting marketing and advertising funds

- Stressing your ability to meet payroll or expenses

- Precluding you from getting quick-pay discounts from your suppliers or vendors

- Preventing you from expanding, taking on bigger customers or new orders

- Watching competitors take advantage of emerging opportunities while you wait on the sidelines

Working capital is opportunity! Let’s talk about some ways you can speed up business cash flow so that opportunity cost doesn’t slow your organization down or keep it from growing as quickly as it might have otherwise.

Speed Up Customer Payments with 7 Proven Tactics

1. Restrict Customer Payment Terms

So this might seem a bit obvious, but one way to get customers to pay faster is to reduce the number of days customers have to pay. This won’t work in every case with some sales platforms or retailers. It could also be perceived negatively in terms of competitive advantage, causing customers to turn to businesses that extend more generous payment terms instead.

2. Factor Receivables

We help speed up business cash flow every day every time we forward an advance on an invoice factored by one of our clients. It works like this:

An organization or entrepreneur that sells products or services on terms to customers (or via third party retailers) factors – or sells – that invoice to us for a small fee (called a factoring fee). Within 1-2 business days, that organization receives an advance on the invoice (or promised payment) of up to 93 percent.

The invoice can be factored in as early as the same day the customer invoice is generated (or the third-party platform statement is received), so instead of waiting weeks or months on payment, the organization can completely eliminate opportunity costs and stay focused on growth. This enables organizations and entrepreneurs to:

- Better align expenses with corresponding revenues

- Meet payroll and operating expenses more readily

- Access working capital needed to capitalize on fast-emerging opportunities

- Increase inventories or supplies to take on more orders or serve larger customers

- Negotiate fast-pay discounts with suppliers to save money on operating expenses

- Reinvest in the organization more quickly (operations, staffing, marketing, advertising, etc.)

3. Provide More Payment Channels

Waiting on customer payments sent via U.S. Mail can add days or even more than a week onto your wait. By adding more payment channels including online pay capabilities you make it possible for customers to choose the payment method that is most convenient for them. In addition, emailing invoices to customers instead of mailing them by postal service may cut additional days off your wait time.

4. Communicate Frequently

Staying in touch with your customers keeps your business top-of-mind and can passively remind them that they should send payment to you. Nor does communication need to be about the customer’s invoice, although this may be a necessity with slow-paying customers. You can stay top-of-mind with customers by sending occasional email newsletters, updates, special offers, or expert advice, thereby adding value to the relationship as well.

5. Think Lean

If you overstock inventories or supplies, then your money could be sitting on the shelf instead of at your disposal. Pay close attention to customer preferences, buying cycles, patterns, and seasonal trends to see where you may be tying up working capital on slow-moving products or services.

6. Create a Formal Process

What kind of plan do you have in place to communicate about slow customer payments? Creating a formal process – almost like an email drip campaign – can remind and encourage customers whose payments are late to bring their accounts up to date.

7. Extend Quick-Pay Incentives

Giving customers some type of incentive to pay you ahead of schedule may speed up your business cash flow. These incentives need not be quick-pay discounts, although that is a commonly used tactic. If you extend discounts, be sure to examine how they will affect your organization’s overall profitability. You may find that the fee for factoring invoices is far less than the amount of customer discount it would take to incentivize early payment.

***